A fragmented “core” and rigid business models: A less agile and inflexible business model, corporate strategy, portfolio composition, asset mix, and supply chain seem to be inhibiting the future of O&G companies. Whether it is the hidden inefficiencies in the portfolio of producers or the lack of a cohesive integration strategy of oilfield service majors, the O&G industry still has a long way to go in making its core future ready.

Prices and rig counts: The COVID-related uncertainty makes trying to project prices and rig counts across a full 12-month period even more of a crap shoot for 2021 than it normally has been. Given that reality, I’ll simply predict that the domestic rig count, which has gradually risen since early September, will continue to rise throughout the first quarter of the year.

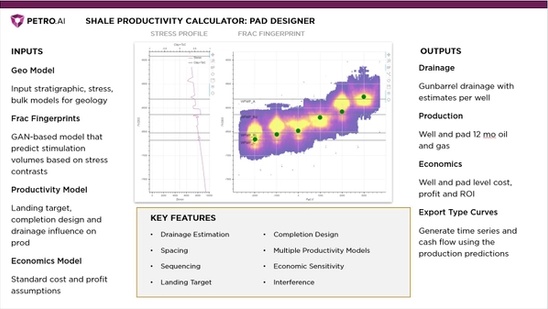

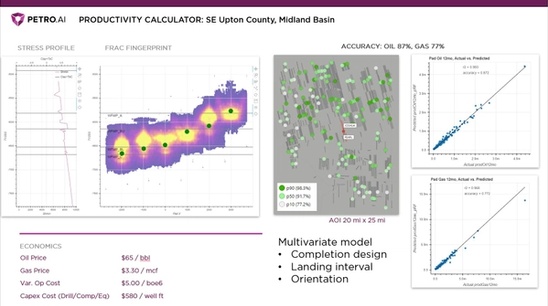

Generating scenarios for well placement and completion options allows decisions about the well to made from a variety of potential designs, adding to the speed of decision and reducing the uncertainty in these uncertain times. Kyle LaMotta, VP of Analytics, explains, “Traditionally a company would never work up large numbers of scenarios because it takes so long to generate those results. They just don’t have a way to capture that variance. At Petro.ai, we can capture that variance with the drainage because every time we change the well spacing or the well placement, it’s going to affect the drainage which ultimately affects the production.”

“Petro.ai’s differentiators include the ability to run those different scenarios and then calculate the drainage and production for each scenario which has been trained on offset acreage. We can use existing production and existing wells to train those models and make those predictions very accurately.

“Let’s look at the well lifecycle. First, there are leases available for development. Then within those leases there are different ways that they can configure the well placement, the intervals that they’re targeting which includes where exactly those wells are landing, the well spacing, the offsets for parent wells.

“There are a lot of different things that can change that are ultimately going to affect the productivity of the wells and the economics.

“I think a lot of the traditional method is making a decision based on what they’ve done in the past. It’s a lot easier to repeat previous designs than come up with a new one. One of the reasons that they do this is because it’s hard to generate all these different scenarios and understand what the economics would be for each one individually. It’s hard to balance those tradeoffs.

“Early on in the process, when they haven’t permitted the wells and they haven’t even decided how many wells they want to put in or what the well spacing should be, Petro.ai is able to come up with a lot of different scenarios so that we can test the well spacing, such as very narrow well spacing up to anything from 400 feet across between wells to 1500 feet between each well. Then space them out in certain increments. Let’s say we run each of those scenarios at 200 foot increments. In that sense you might come up with 8 or 10 different spacing considerations.

“Then within those spacing considerations you can say which intervals you want to target. So maybe you’re looking at two intervals or three intervals and you want to look at the tradeoff of adding that third interval. So, it’s another layer of complexity that Petro.ai can add.

“Then within those intervals you can vary the well placement. Maybe you’re targeting the middle of the zone or maybe you want to do 100 feet from the top of the zone. That adds another layer. Each time you add a new dimension it adds a new complexity.

“When you’re looking at one particular DSU or drilling section that you’re going to develop, there might be hundreds of different configurations of wells and well counts and placements.

“You can take it a step further and say once we’ve decided on the pad design, how does our completion design affect the productivity of the wells? This adds another dimension.

“You can start to see how these interconnected decisions create a tree of branching alternatives till you have a rich arbor of scenarios to choose from. Each one of those scenarios has a potential revenue and a potential oil production.

“Being able to generate all of those scenarios quickly and calculate all of the production for each one of those pads and the economics for each one of those allows you to understand the tradeoffs. Then you hone in on certain pads that are most optimally based on the current economics. What may be economic at $30 oil is not going to be the same as $80 oil which is what we have today.

“The ability to generate all of those scenarios and make a decision from a variety of potential designs adds to the speed of decision and reduces uncertainty.”