Petro.ai: Confident investment. Petro.ai knows, “The need for strong and effective buy-side financial due diligence has perhaps never been greater as margins for errors in negotiated transactions have narrowed in lock-step with operating margins.” (Opportune)

Petro.ai: Puts all the buy-side needed analytics in one platform, neatly laid out so that variables can be changed and analyzed in an apples-to-apples comparison. Forecast reliably, compare conveniently, decide with confidence.

Oil and gas buy-side investment means being in the moment. The right moment. And being right. It means fast, accurate, complete predictive analytics. It means pouring your barrels of data into an AI, multivariate analysis engine that gives you the answers you need in this moment.

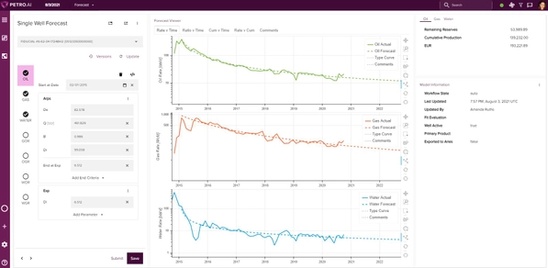

Petro.ai is that engine of forecasting, rock insight, geomechanical reveals, type curves, and comparison ROI that builds your complete due diligence on wells and oil and gas reservoirs from zero to done in a matter of a few right minutes.

Richard Gaut, CFO of Petro.ai, explains, “We can split the financial sector into a few different categories and different needs. Banks and private equity funds have different needs. And there’s different kinds of banks within the sector. There are banks that collect data and clean it up, build a presentation and try to solicit lots of buyers. Those are sell-side banks. Sell-side people are deeply focused on one deal at a time and try to make it look as good as they can.

“Then on the buy-side, buy-side advisers, they are shopping. They might be looking at many deals at a time, but they want to take the information that’s been presented to them by the seller and then do their own due diligence. It’s like buying a used car, it’s been cleaned and it’s going to look as nice as a seller can get it to look but you need to do your own work, kick the tires and look under the hood. You don’t just take the seller’s word for it; you pull the car facts, and you figure out what you’re buying.”

According to Investopedia, “In contrast to the sell-side analyst position, the job of a buy-side analyst is much more about being right; benefiting the fund with high-alpha ideas is crucial, as is avoiding major mistakes. In point of fact, avoiding the negative is often a key part of the buy-side analyst's job, and many analysts pursue their job from the mindset of figuring out what can go wrong with an idea.”

"The sell-side people have already done their work. They've polished things.

“Now the buyers have two problems: they need to sort through the promises and make their own assumptions and do their own diligence and Petro.ai can automate that. Or if you’ve already spent the money and are about to inherit the asset, Petro.ai can do the work and get your wells better and faster.

“Petro.ai provides a complete platform where you can crunch through your tsunami of data fast and not have to accept the default inputs,” Gaut continues. “You don’t want to take the default b factors, the default decline rates, the default GORs that are given to you by the seller. Instead, you want to compare their numbers to public data sets. You want to run your own analysis in your own trusted platform which gives consistent, accurate results.

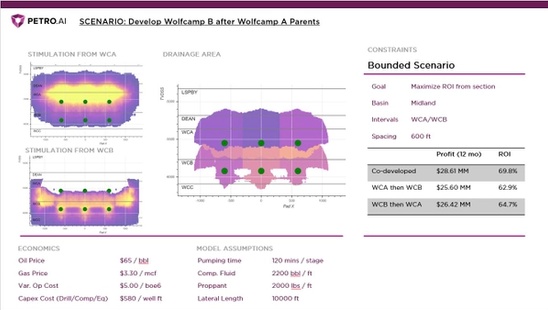

“Maybe as a buyer you have assets in the same potential area. With Petro.ai you can compare the performance of the new wells to your own data. Petro.ai can blend the public and private data and then contextualize it by lateral length, by landing zone, by completion year, by completion intensity, by parent/child associations—all automated and reliable. You can be a more informed buyer when you look at what’s been presented to you by the sell-side.

“A real differentiator for Petro.ai is its ability to make accurate forecasts. You have to convince the investment committee that your forecast is trustworthy and reasonable. You can make your excel model return big dollars but is that forecast accurate? Are you making reasonable assumptions, based on the science and the ROI to make that excel model spit out a lot of money in year 5?

“Petro.ai incorporates subsurface information, engineering information, geological information, geomechanics information. We incorporate data from a variety of sources to create more accurate forecasts for the specific areas where there’s potential investment opportunities. And that high accuracy from Petro.ai is created with a multivariate AI analysis that includes well-to-well interaction, quantifying parent/child effects and using the Pad Designer App instead of only type curve technology. The Pad Designer is 10x more accurate than the existing type curve methodology and provides trade-off scenarios rather than just the baseline type curve ballpark estimations. If you want to change the parameters you can, but you’ll be just fine using our default parameters.

“As you work to make the decision to buy, you wind up looking at a lot of data that may or may not be organized or actionable and the pressure is going to be on you to execute. With Petro.ai, you bring in that data, put it through the predictive analytical workflows to create easy-to-read-and-use due diligence reports.

“And then once you’ve purchased, Petro.ai can help you wrap your arms around the data sets that you’re inheriting and deliver something actionable so that you can start to make forecasts. You can start testing well spacing patterns and hit the ground running after you make that investment. Petro.ai is built to help you make the trade-offs, to sift through your options in optimizing your investment. From should I buy to where do I drill, Petro.ai is a complete platform for your investment journey.”